IB BUsiness MAnagement:

|

|

Cash flow - Working CapitalCash is often referred to as the 'lifeblood' of a business. All businesses need finance to pay for everyday expenses such as wages and the purchase of stock. Without sufficient cash flow or working capital a business will be illiquid - unable to pay its immediate or short term debts. Either the business raises finance quickly, such as a bank loan, or it may be forced into liquidation by its creditors, the firms it owes money to.

Working capital = current assets - current liabilities. |

Working capital - definition: The capital needed to pay for raw materials, day-to-day running costs and credit offered to customers. In accounting terms:

Working capital = current assets - current liabilities. Liquidity - definition: The ability of a firm to be able to pay its short-term debts. Insolvent - definition: When a business cannot meet its short-term debts. |

What is working capital? |

What is cash flow? |

Working Capital:

|

Working Capital ManagEmentThere are many different options available to businesses to more effectively manage their working capital requirements.

|

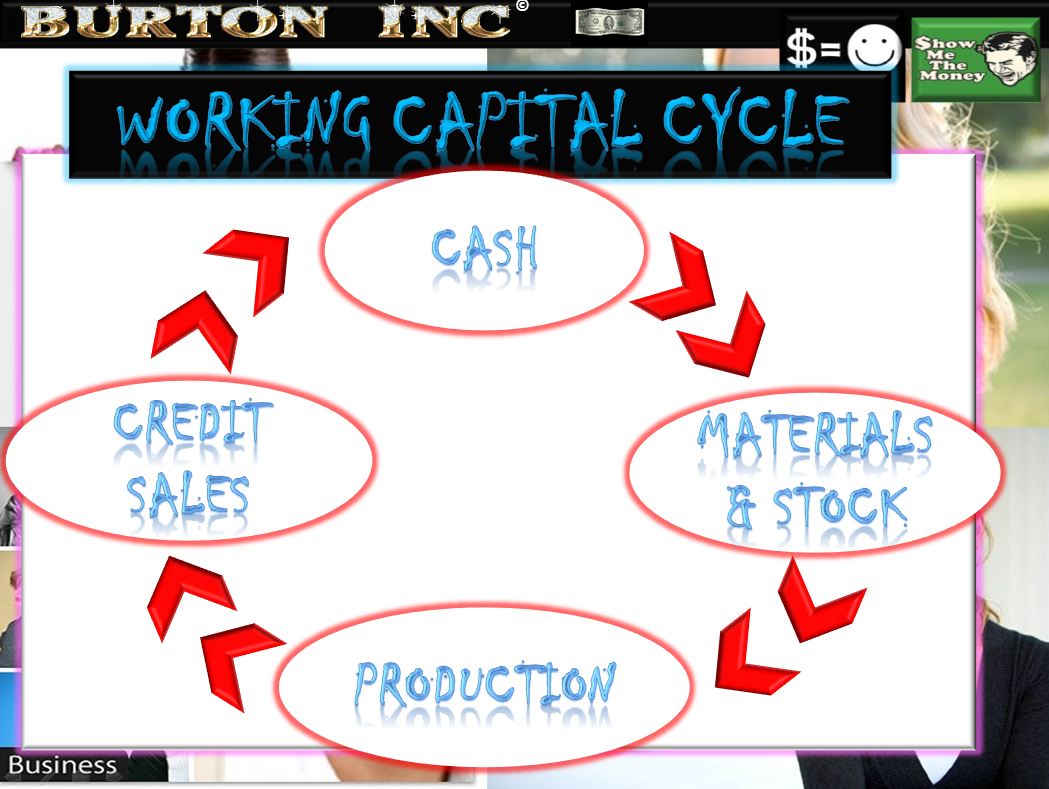

The working capital cycle:

Working Capital Cycle - definition: The period of time between spending cash on the production process and receiving cash payments from customers.

The longer this cycle takes to complete, the more working capital a business will need.

|

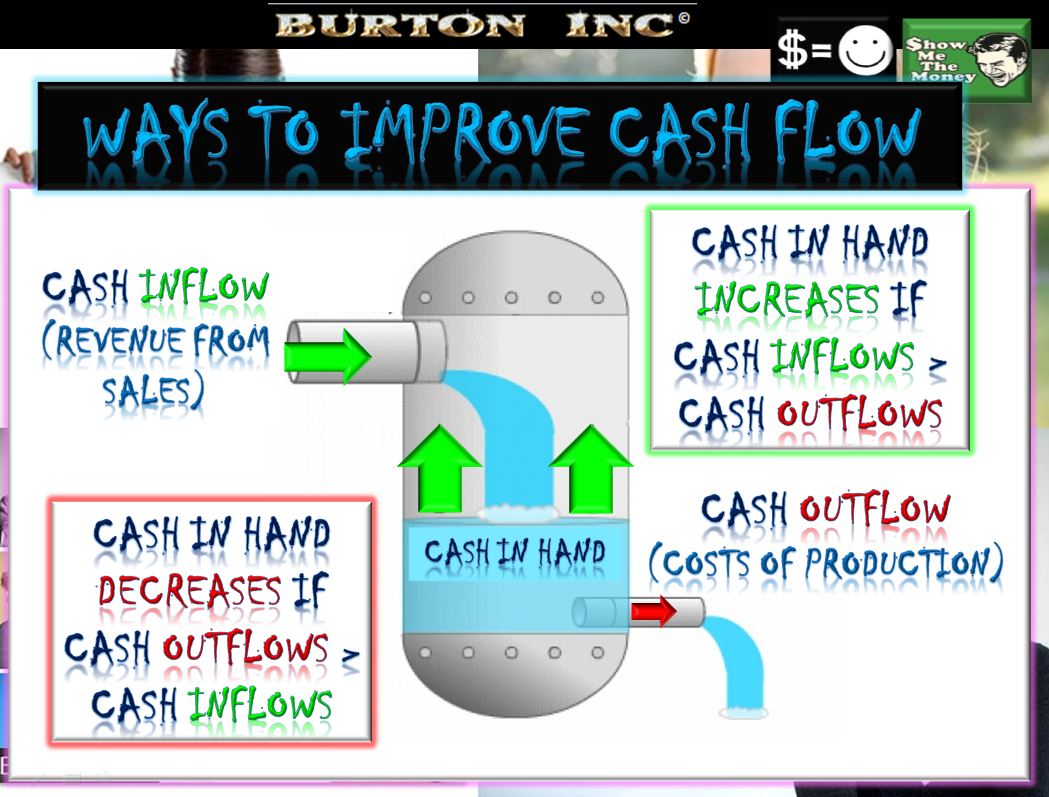

What is free cash flow?Cash flow - definition: The sum of cash payments to a business (inflows) less the sum of cash payments made by it (outflows).

Cash inflows - definition: Payments in cash received by a business, such as those from customers (debtors) or from the bank; e.g. receiving a loan.

Cash outflows - definition: Payments is cash made by a business, such as those to suppliers and employees.

|

The importance of cash flowCash is always important - short-term and long-term. Cash flow relates to the timing of payments to workers and suppliers and receipts from customers. if a business does not plan the timing of these payments and receipts carefully, it may run out of cash even though it is operating profitably. If suppliers and creditors are not paid in time, they can force a business into liquidation of its assets if it appears to be insolvent.

Note: Cash is not the same as profit. It is very common for profitable businesses to run short of cash. On the other hand, loss-making businesses can have high cash inflows in the short-term. The diagram on the right explains the links between cash inflows - in the form of revenues - and cash outflows - the costs of production. Working capital is what keeps a business solvent.

|

Cash inflows and outflows |

Cash Flow forecastingForecasting cash inflows, examples include:

Forecasting cash outflows, examples include:

Preparing a Cash Flow Forecast:

|

Why cash flow matters

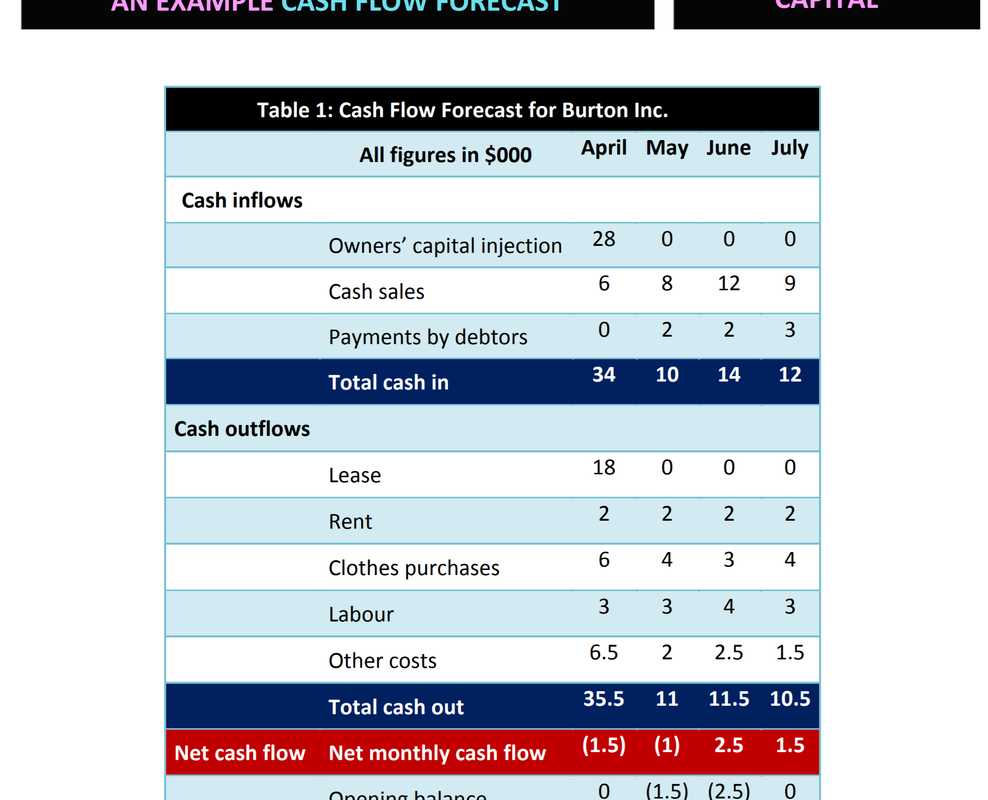

An example cash flow forecastKey Terms:Cash flow forecast: Estimate of the firm's future cash inflows and outflows

Net monthly cash flow: Estimated difference between monthly cash inflows and outflows Opening cash balance: Cash held by the business at the start of the month Closing cash balance: Cash held at the end of the month becomes next month's opening balance |

Causes of cash flow problems:

1. Lack of planning

2. Poor credit control 3. Allowing too much credit 4. Expanding too rapidly 5. Unexpected events Credit controlCredit control: Monitoring of debts to ensure that credit periods are not exceeded

Bad debtsBad debts: Unpaid customers' bills that are now very unlikely to ever be paid.

|

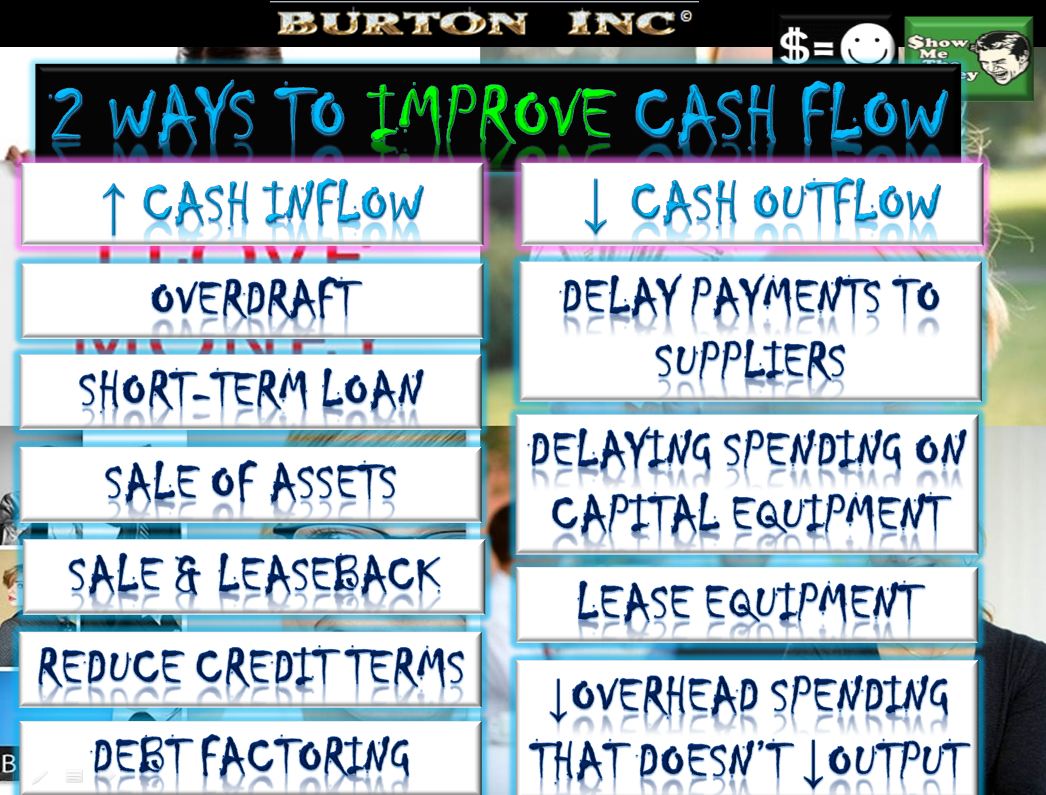

Improving Cash Flow |

3.7 Cash Flow:

Summary PowerPoint notes

Exam Tips!

|

Progress check - test your understanding by completing the activities below

You have below, a range of practice activities, flash cards, exam practice questions and an online interactive self test to ensure you have complete mastery of the IB Business Management requirements for the Finance and Accounts 3.7 Cash Flow topic.

IB BUSINESS MANAGEMENT QUIZZES AND TWO CLASSROOM GAMES

Test how well you know the IB Business Management Finance and Accounts - 3.7 Cash Flow topic with the self-assessment tool. Aim for a score of at least 80 per cent.

|

Loading 3.7 Cash Flow A

Loading 3.7 Cash Flow B

|